The world within finance is a radical transformation. Enter DeFi, this decentralized financial built on copyright. DeFi promises to transform traditional models, offering individuals increased control over their assets. From lending and borrowing to decentralized platforms, DeFi is a variety of groundbreaking products.

- Despite the potential is vast, the decentralized finance landscape encounters risks.

- Governmental uncertainty lingers, as well as the complexity of DeFi can a obstacle for average use.

Nevertheless, This emerging technology's potential to empower individuals and the financial landscape remains undeniable. With ongoing innovation, DeFi could transform the outlook of finance, driving a more accessible financial world.

Mastering the copyright Market Volatility

The copyright market is known for its volatility. Prices can plummet in short periods, making it a daunting landscape for investors. Nevertheless, understanding the forces behind these movements and adopting a prudent approach can help you weather this volatile terrain.

One key to profitability in copyright is diversification. Don't put all your eggs in one basket by spreading your investments across a spectrum of cryptocurrencies, each with its own unique characteristics.

Another important factor is fundamental analysis. Go beyond market trends and delve into the underlying value of the cryptocurrencies you're considering. Research can help you identify promising projects with real-world applications.

Finally, always remember to implement risk management. Set profit targets to protect your investments from market downturns. Avoid impulsive decisions and stick to your investment plan even during periods of market uncertainty.

Distributed Ledger Technology: Revolutionizing Transactions

Blockchain technology is disrupting the way we conduct transactions. Its distributed nature eliminates the need for trusted third parties, making transactions more secure. Each transaction is logged in a immutable chain of blocks, ensuring trust. This innovative technology has the potential to streamline a wide range of industries, from finance and supply chain management to healthcare and voting.

The Rise of NFTs: Redefining Ownership

NFTs have exploded onto the scene, transforming how we perceive digital possession. While initially known for their role in disrupting the art world, NFTs now reach far beyond. From gaming, to music, NFTs are creating a decentralized future where {creators{ and collectors more info can collaborate. This transformative landscape offers exciting avenues for both individuals and institutions, blurring the lines between the physical and digital realms.

A Surge of Decentralized Governance

A new era is brewing in the realm of governance, one characterized by accountability. Decentralized governance structures, powered by blockchain technology and self-executing protocols, are disrupting traditional power structures. Stakeholders now participate in decision-making processes, enabling a more inclusive landscape. This shift is gaining momentum across domains, from finance and technology to governance.

- Furthermore, decentralized governance promotes collaboration, breaking down silos and fostering a more decentralized network of power.

- However, challenges remain, including security.

As this, the future of governance appears to be increasingly decentralized. This trends hold the opportunity to reshape our world for the better, constructing a more sustainable future.

Exploring into copyright Investing 101

copyright speculating can seem like a daunting journey, but with a spark of knowledge, it can be an exciting venture. Before you leap into the sphere of digital tokens, it's essential to understand the principles. Start by researching different cryptocurrencies and their core technologies. Identify your risk tolerance and craft a balanced investment plan. Always remember that digital assets are volatile, so proceed with caution.

- Remain informed about industry developments.

- Use secure exchanges.

- Under no circumstances allocating capital more than you can risk.

Consider yourself savvy investor and approach the sphere of copyright diligence.

Tia Carrere Then & Now!

Tia Carrere Then & Now! Charlie Korsmo Then & Now!

Charlie Korsmo Then & Now! Danica McKellar Then & Now!

Danica McKellar Then & Now! Danny Pintauro Then & Now!

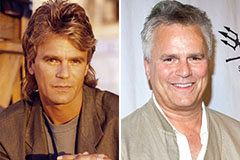

Danny Pintauro Then & Now! Richard Dean Anderson Then & Now!

Richard Dean Anderson Then & Now!